Digitizing insurance distribution for

Banks Lenders Insurance Brokers Fintechs Insurance Companies Any digital platform

Seamlessly launch and scale insurance distribution with AI-driven orchestration, intelligent workflows and enterprise-grade infrastructure.

0

+

insurance products from 40+ insurers

0

+

enterprise customers

Trusted by 50+ enterprises across India and the Middle East

Industries

Edit Content

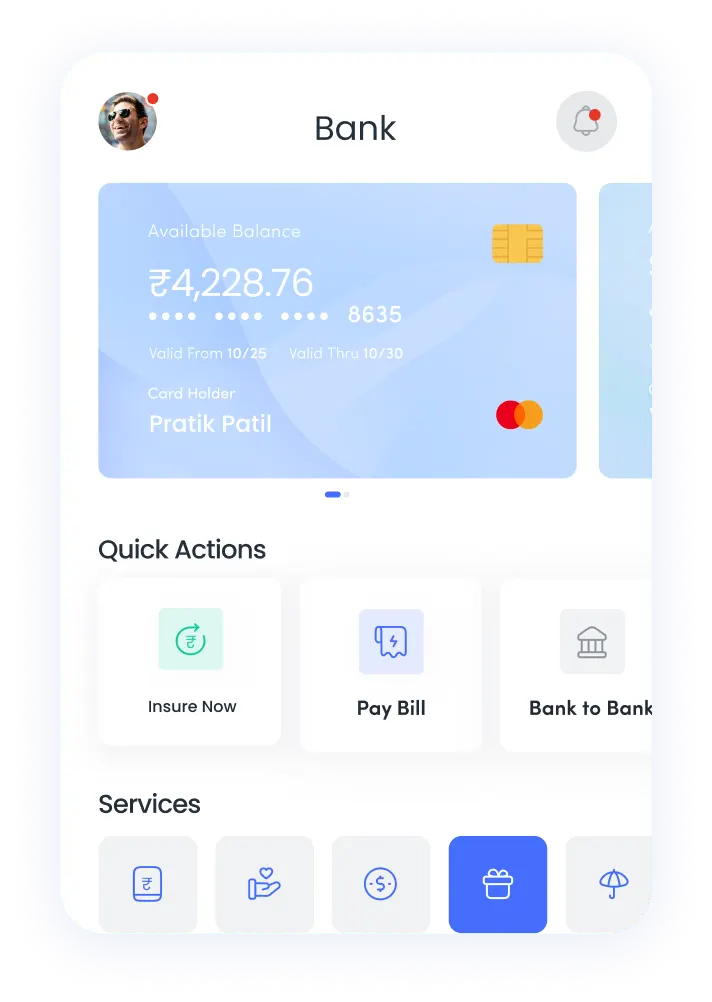

Banks

Embed insurance seamlessly across core banking journeys – account opening, payments, lending, and servicing using an AI-driven distribution platform. Launch products faster, personalize offers, and gain real-time visibility into policies, transactions, and compliance through a unified dashboard.

Edit Content

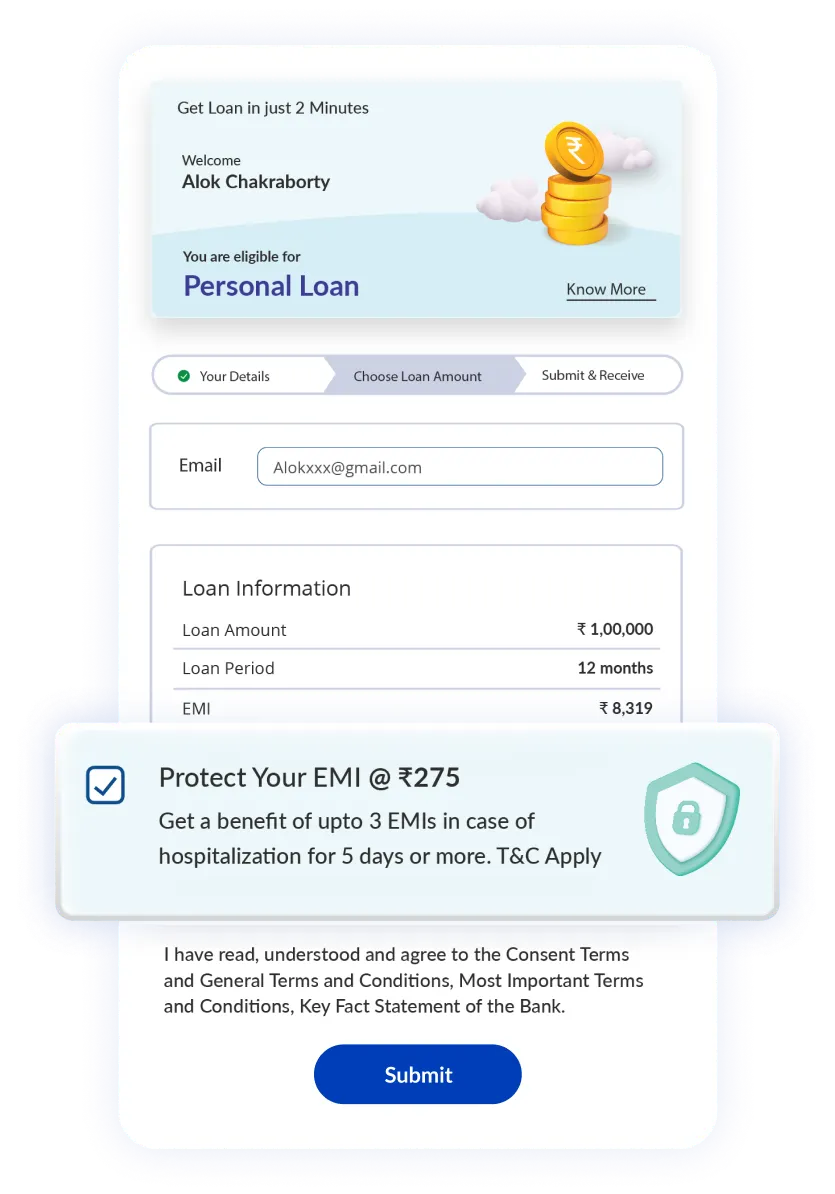

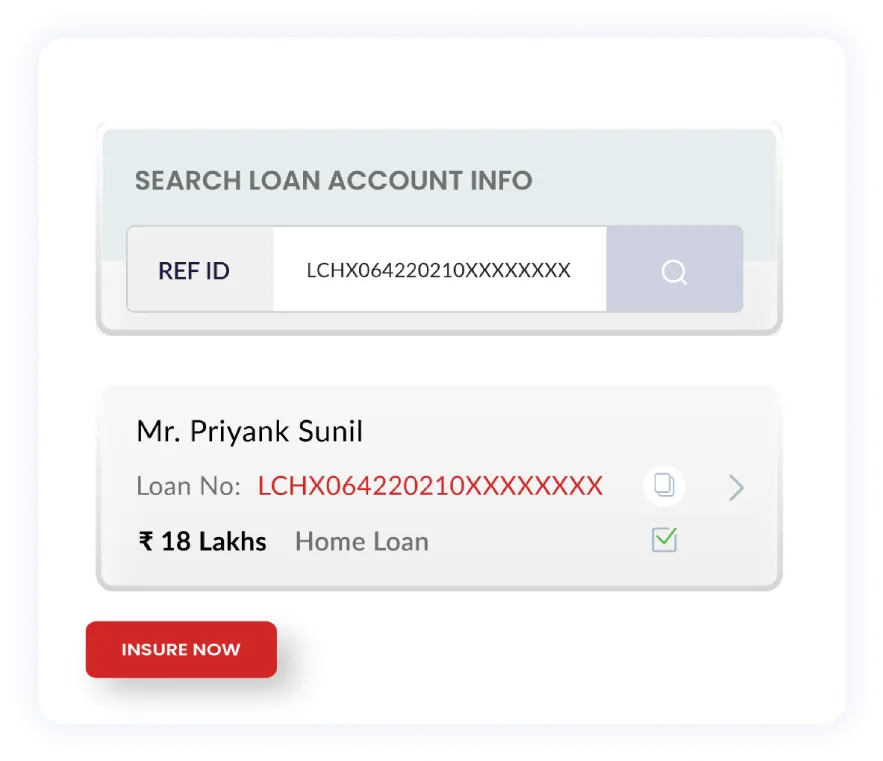

Lenders

Enable credit-linked insurance across loans, mortgages, and consumer finance without disrupting existing workflows. Use AI-led recommendations and claims automation to improve attach rates, accelerate launches, and drive cross-sell while maintaining control over reporting, compliance, and partner integrations.

Edit Content

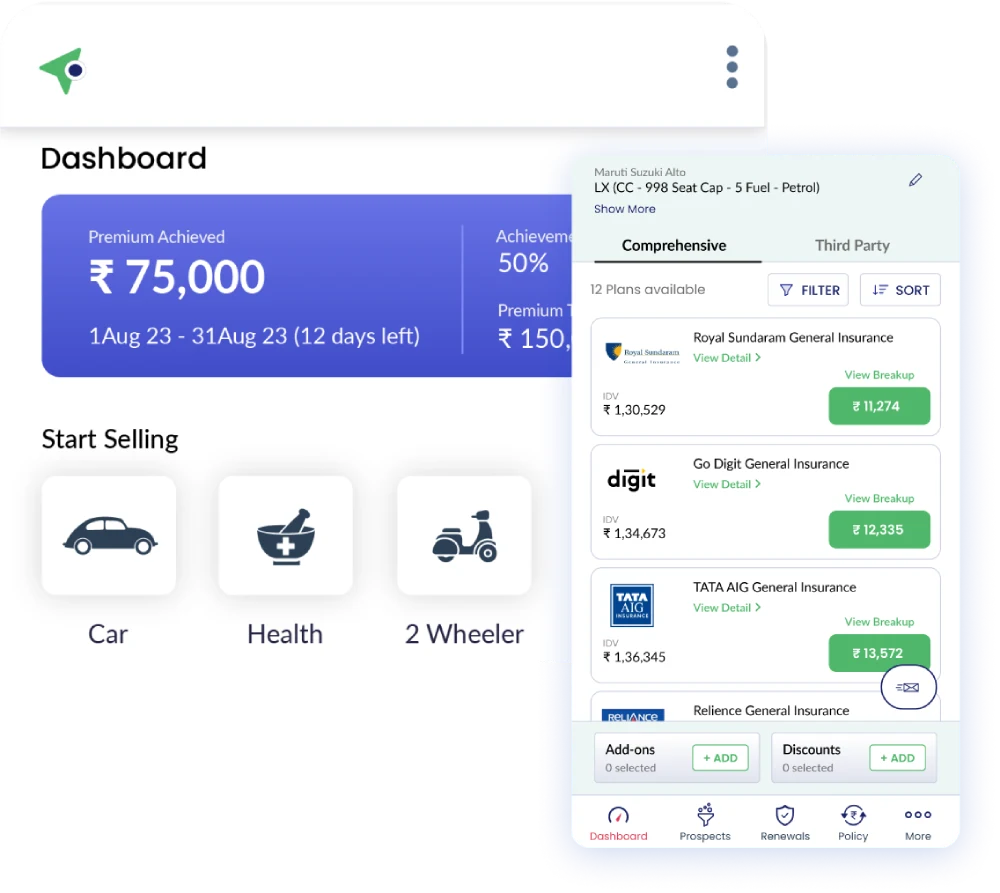

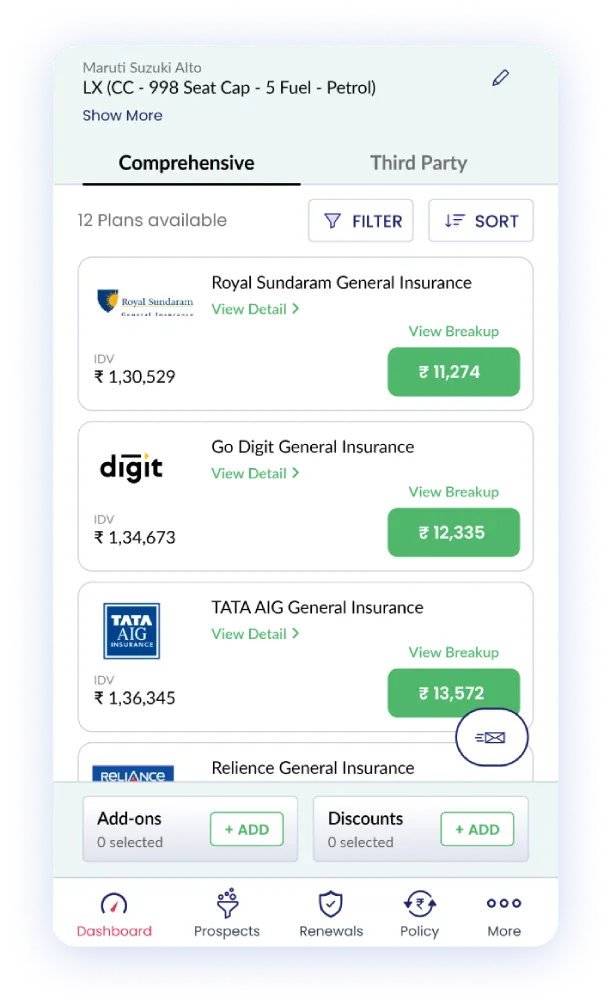

Insurance Brokers

Launch and scale your digital brokerage with a platform for real-time quotes, comparisons, and policy issuance. Digitize the entire insurance lifecycle from onboarding and sales to servicing and renewals without the burden of building or maintaining in-house tech.

Edit Content

Insurance Companies

Simplify multi-channel distribution across agents, bancassurance, brokers, and embedded partners with a unified AI-first middleware layer that sits on top of your system of records. Launch products faster, automate claims and servicing, and gain end-to-end visibility across policies, commissions, and compliance.

Edit Content

Embedded Insurance

Enhance your customer experience by offering contextual insurance offerings at the point of sale. From rent and EMI protection to cyber insurance, credit-life, and more, provide your customers with what they need when they need it.

Edit Content

Fintechs

Streamline insurance attachment with loans digitally, without hampering your current loan workflows. Boost insurance cross-sell, optimize sales productivity, and launch new products swiftly, all within weeks.

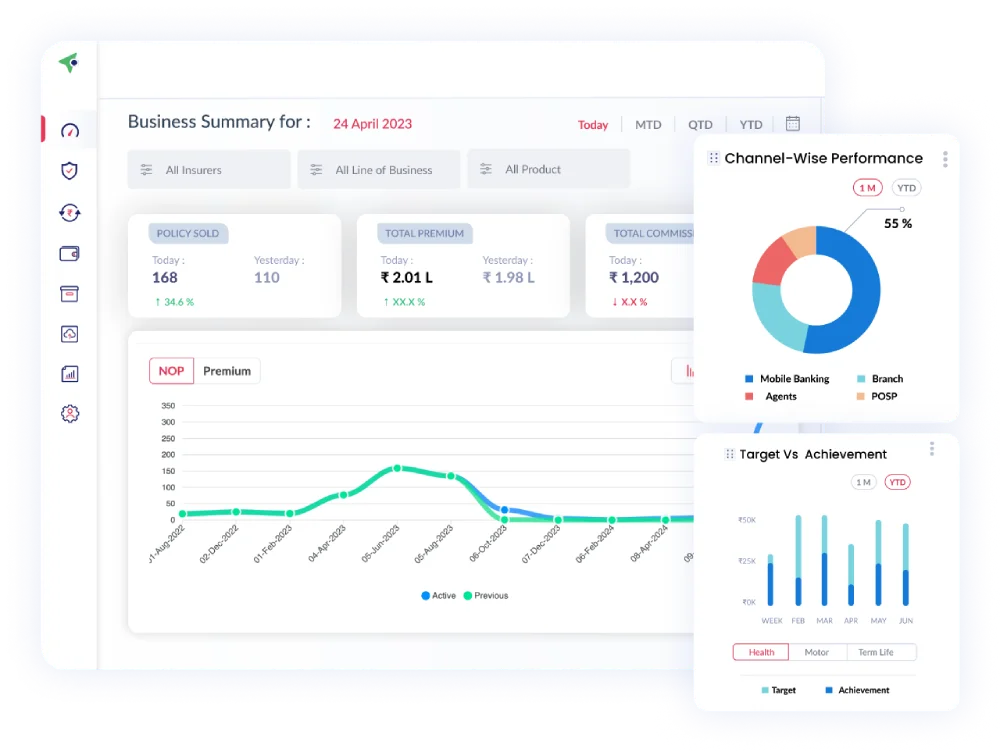

Streamline and manage insurance business digitally

Transform your insurance operations from traditional high-touch, paper-based processes to seamless end-to-end digital distribution. Enhanced sales productivity, better customer experience.

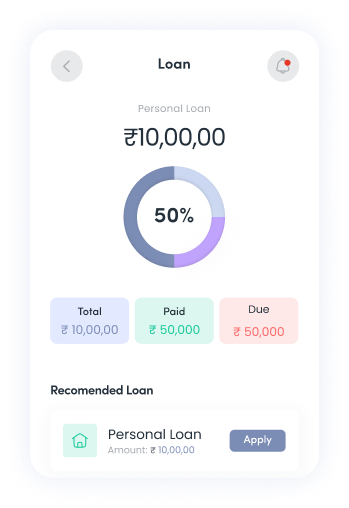

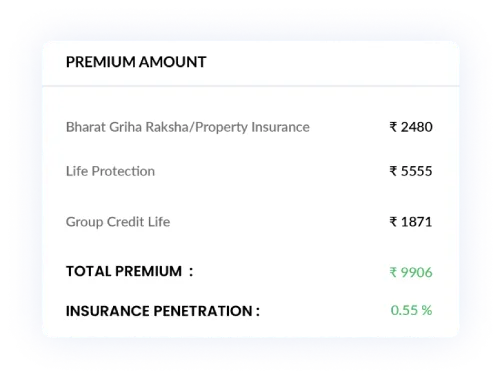

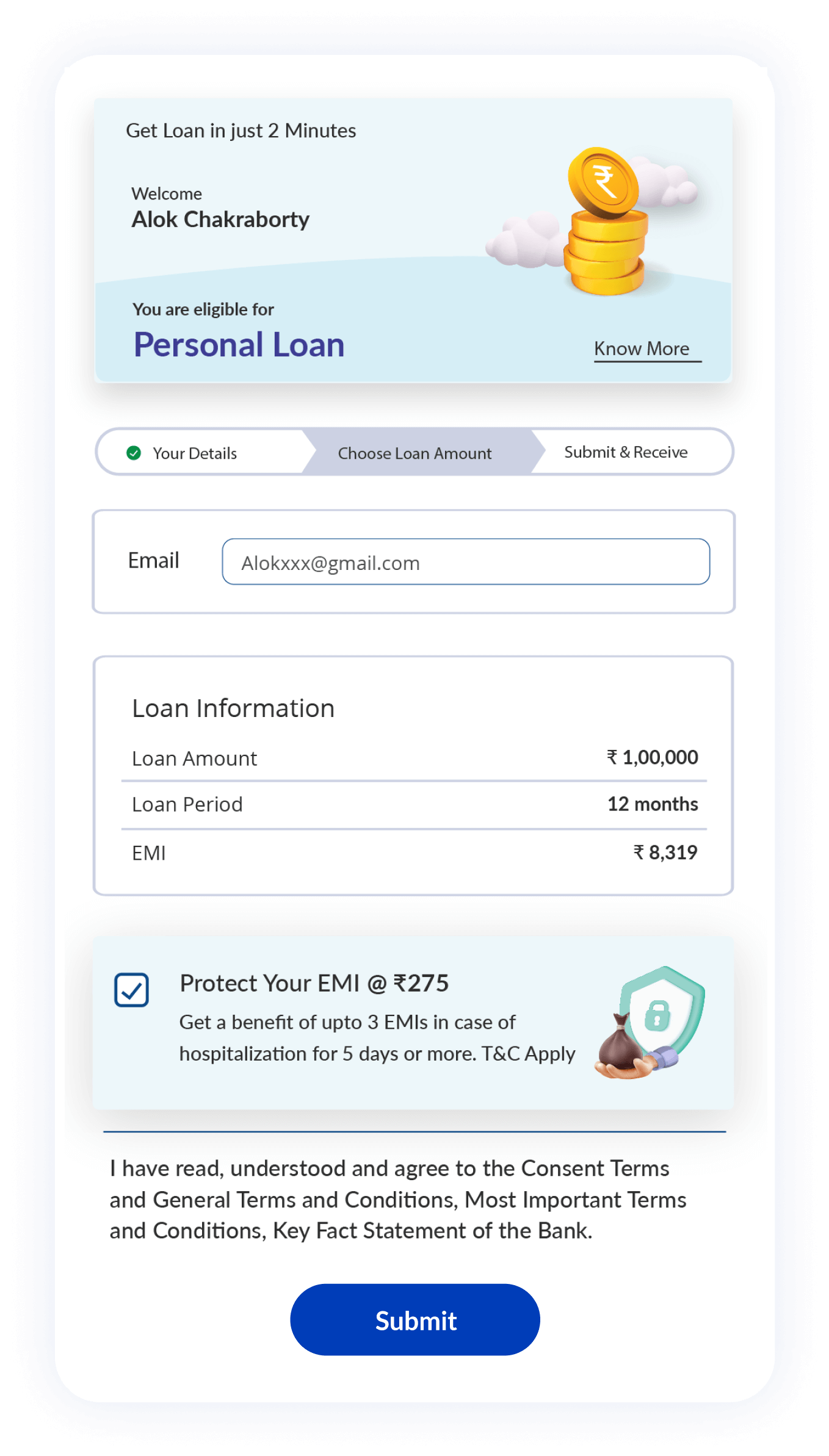

LendPro

Automate all processes involved in insurance attachment with loans

- Integration with multiple LOS

- Automatic premium calculator

- Remittance dashboard

EmbedPro

Offer most relevant insurance cover to your users, within existing purchase journeys

- Recommendation engine

- No code product configurator

- Dynamic SDKs

RetailPro

Digitize end-to-end retail insurance distribution from quote generation to real-time policy issuance

- Single product journeys

- Compare & buy journeys

- POSP app

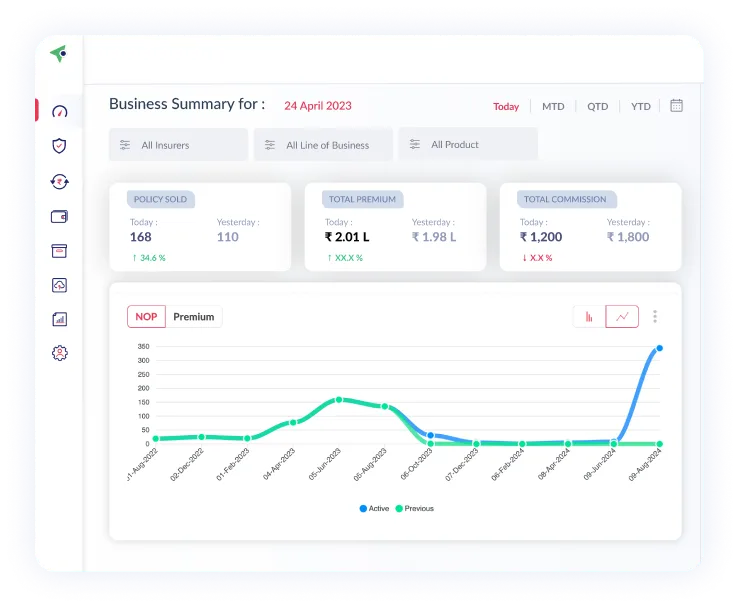

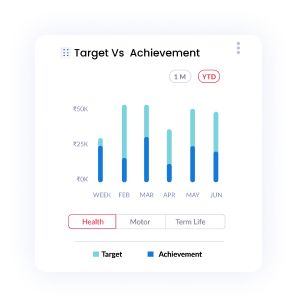

Console

Gain instant performance insights with real-time sales reporting and MIS

- Lead tracking

- Hierarchy management

- Regulatory reporting

Top Housing Finance Company leverages LendPro to automate insurance attachment with loans

- New products & insurers onboarded in just 1 month

- Remittance & reconciliation time reduced to 1 day

- Policy issuance happening in day 0

Leading broker launched its own digital platform in just 3 months, featuring 42 products from 25 insurers

- No. of insurers increased from 6 to 25

- 60% improvement in operational efficiency

- 70% faster sales closure time

- 6.5X increase in Gross Written Premium (GWP)

The smartest way to scale insurance distribution

AI-enabled. Configurable. Enterprise-ready.

Asia’s fastest-growing insurance infrastructure platform.

Asia’s fastest-growing insurance infrastructure platform.

Purpose-built modules that enable all GTMs for insurance distribution. Cross sell retail insurance with DIY or Assisted user journeys. Embedded insurance with loans, or any digital transaction.

Omni-Channel Distribution

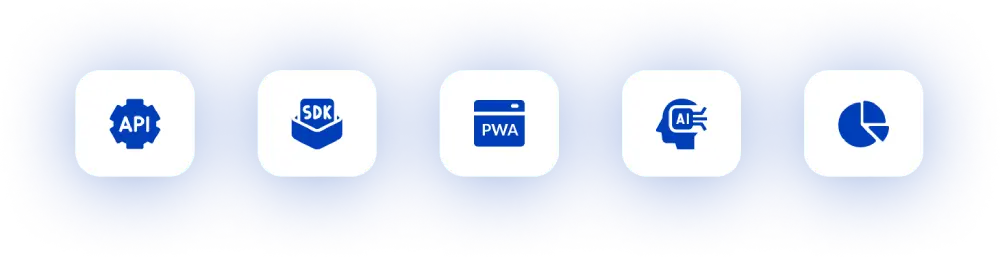

Integrate Unified APIs to create your own native user experiences. Or leverage white labelled platforms for a quick GTM.

Unified APIs & White Labelled Solution

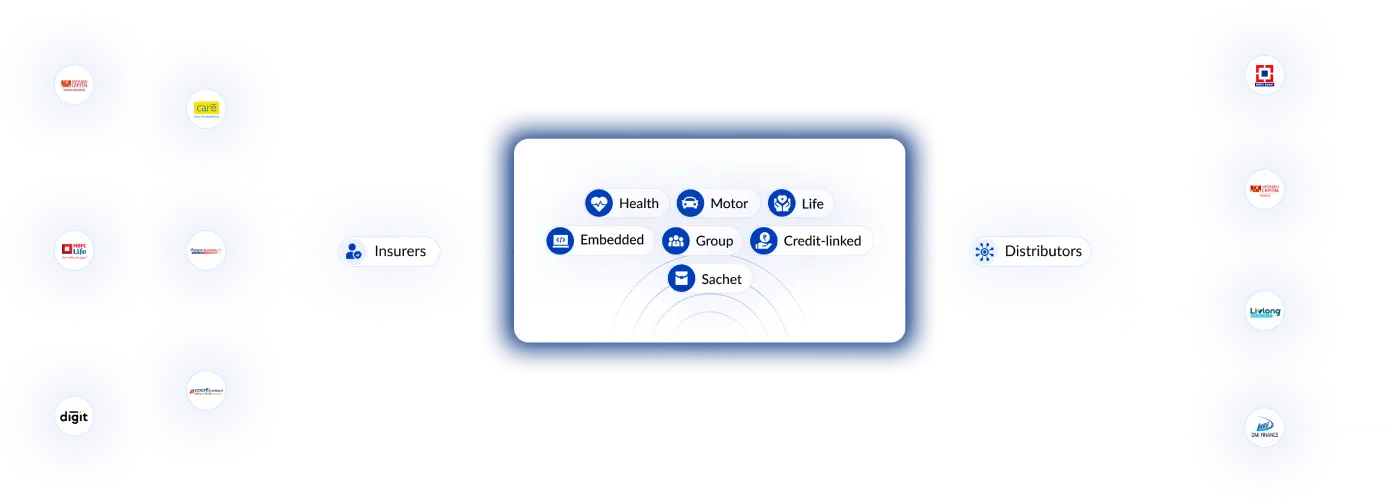

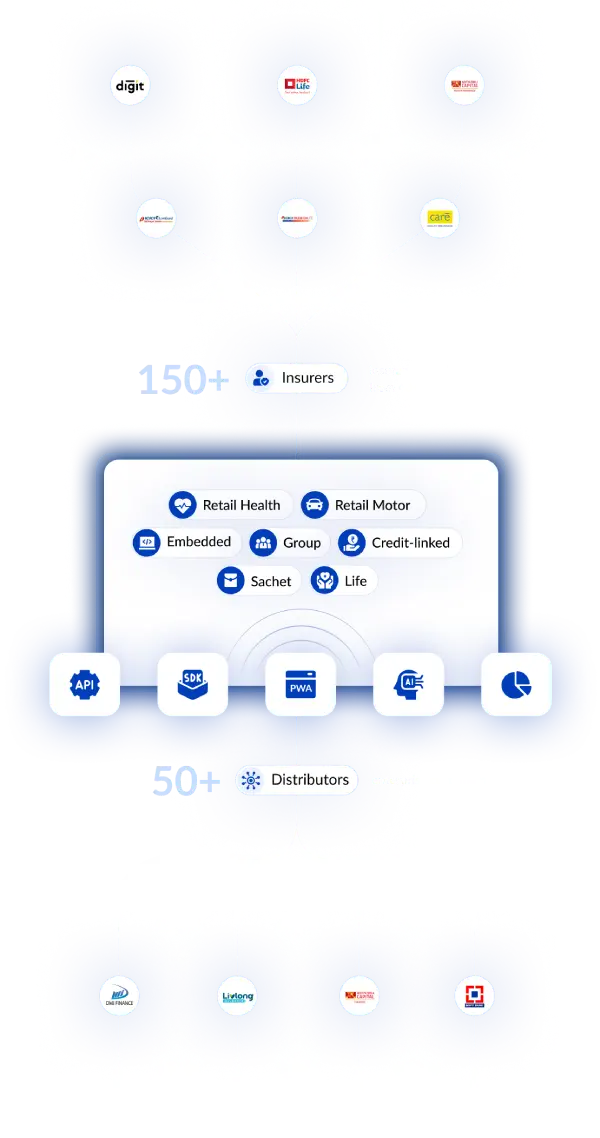

Offer any insurance product from any insurer of your choice. More than 150 products from 40+ insurers come pre-integrated across life, health, motor, credit linked and sachet insurances.

Pre-Integrated Platform

Leverage agentic AI workflows that connect your systems, data, and distribution channels. MCP Server acts as a universal connector, enabling you with AI-native journeys from quote to claims.

AI Workflows with MCP Server

Deliver relevant insurance recommendations in real-time, personalized to every customer group, enhancing satisfaction and loyalty.

Data Intelligence with AI Recommendation Engine

Category creator of Insurtech Infrastructure space

$

0

Mn +

Insurance premium processed

0

+

Insurance product APIs

0

Mn +

Policies issued

0

+

Enterprise customers across India & MENA

Best AI Innovation for Insurance Distribution by UBS Forum

Winner National Startup Awards 2021

Top 50 Insurtech Startup by Sonr

Insurtech of the Year 2023 by BW Festival of Fintech

Investors

Ready to digitally transform your insurance business?

Built in India. Deployed across Asia and the Middle East. Expanding globally.